Award-winning PDF software

General Bill Of Sale Form: What You Should Know

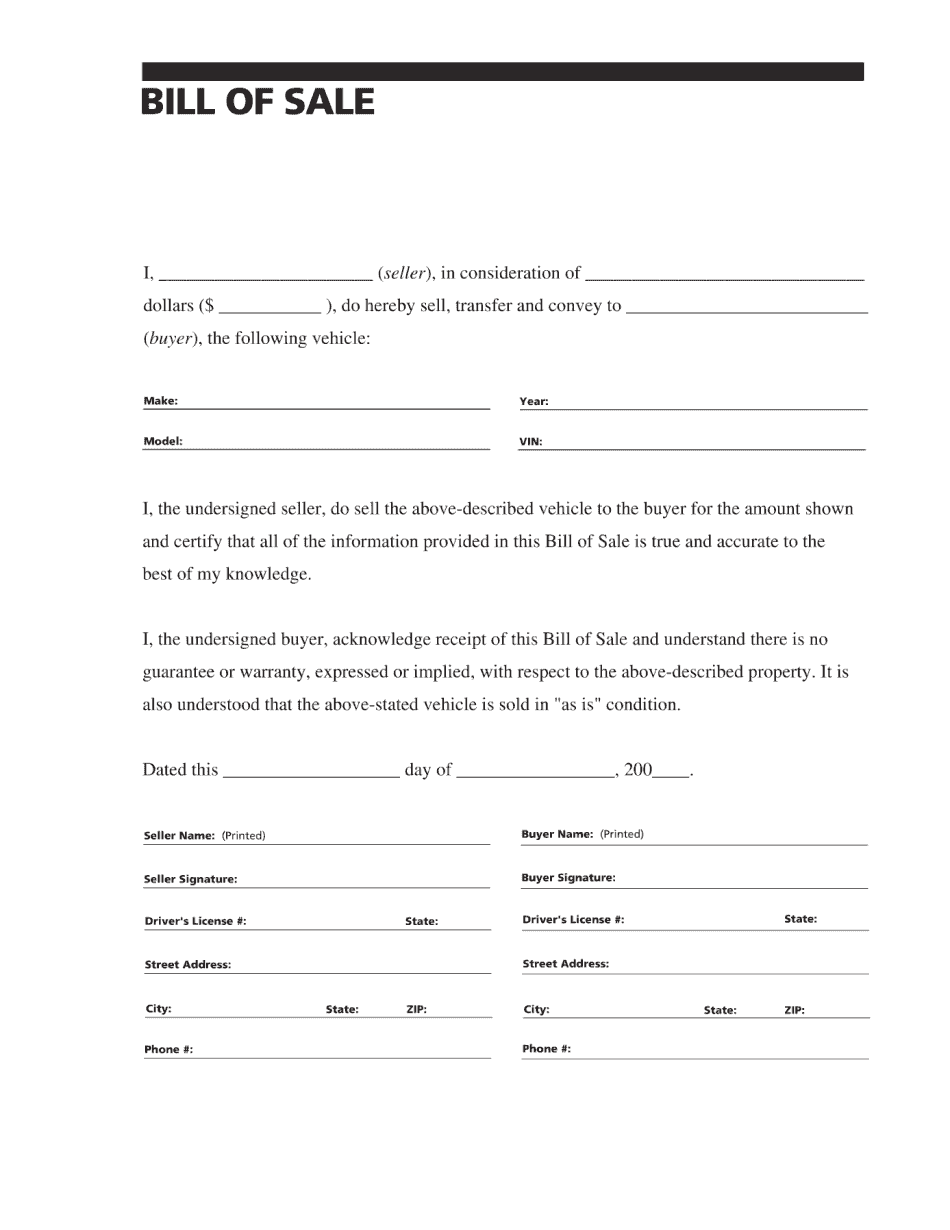

For all transactions involving real estate, a Bill of Sale must be completed before the property is sold and after the sale is completed. How do I use a Bill of Sale? You must complete a Bill of Sale, if you are buying or selling your property or any asset with one or more of the following: • A house • A land lease • An apartment • A rental property • A trust • Property taxes • A bank or investment firm • Cash • Stocks • Bonds • A bank statement • A personal check • A check or money order • A mortgage • A loan • A business license or membership • A business registration (Mortgage); A business name change • (Check the Business Name and Address for your business, you MUST Pay the proper fees and file for a real estate broker license within 30 days); A title insurance policy • A loan or debt • A judgment • A lease that is not in writing • A deed of trust • The agreement between the buyer and seller • Your signature To submit your payment, please provide a completed copy of your Bill of Sale Payment or Payment With Intent to Withhold Form The receipt will be sent to you via email to the email address provided. We are the original creator of this Bill of Sale form, this form does not make or break the sale. There have been A number of different bills of sale that have been found successful. Some of these different forms are listed in our Bill of Sale form gallery. Payment with Intent to Withhold Form If a buyer wants to take the Property without selling it and pays the owner the full price as set forth in this Bill of Sale Form, by notifying the seller via email we are able to allow the buyer to keep the Property. We provide two options- either pay the seller 400 with no intent to withhold the rest and the money goes into a trust or the seller pays the buyer 100 cash, 400 in Bill of Sale 100 with no withholding with the remainder going directly into the owner's name and all fees were paid. The Bill of Sale with no withholding is preferred by many bidders because it allows them to keep the property until the sale is over. It is also the most secure for everyone and the most profitable for both buyer and seller.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Bill Of Sale, steer clear of blunders along with furnish it in a timely manner:

How to complete any Bill Of Sale online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Bill Of Sale by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Bill Of Sale from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.